Device Security & Management for Lenders

Increase your repayment rates, reduce risk and scale confidently. Built by lenders for lenders for device management

What Lendlock do for you?

Simplify payments, secure your assets, and grow your lending business with LendLock.

Secure your devices, secure your loans.

LendLock protects financed devices, ensuring your assets are always under your control. Increase trust and confidence in your lending portfolio.

Never miss a payment.

LendLock automates payment reminders and collections, helping your customers stay on track and improving your repayment rates.

Real-time visibility, anytime.

Track the status and location of every financed device through a unified dashboard. Receive instant alerts if anything needs attention.

Instant action, zero stress.

Easily lock or recover devices remotely if terms are breached, keeping your investments safe at all times.

Key features offering

Designed for Embedded Credit & Device Financing Growth

Remote Lock & Recovery

Take control with the ability to remotely lock or unlock any device in your portfolio. Protect your assets and respond instantly to late payments or lost devices.

Secure loans todayDevice Geolocation

Pinpoint the exact location of financed devices. Improve recoveries, reduce losses, and gain peace of mind with real-time geolocation tracking.

Secure loans today

Flexible APIs Integration

Connect LendLock seamlessly to your existing systems. Our developer-friendly APIs enable fast setup and smooth data flow for all your operational needs.

Secure loans today→

Automated Payment Nudges

Boost your repayment rates with gentle, timely reminders sent automatically to borrowers. Reduce defaults and maintain positive relationships.

Secure loans today→

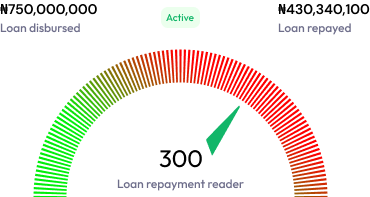

Risk Analytics Dashboard

Stay ahead of risk with advanced analytics. Monitor trends, spot potential problems early, and make informed lending decisions with easy-to-read dashboards.

Secure loans today→